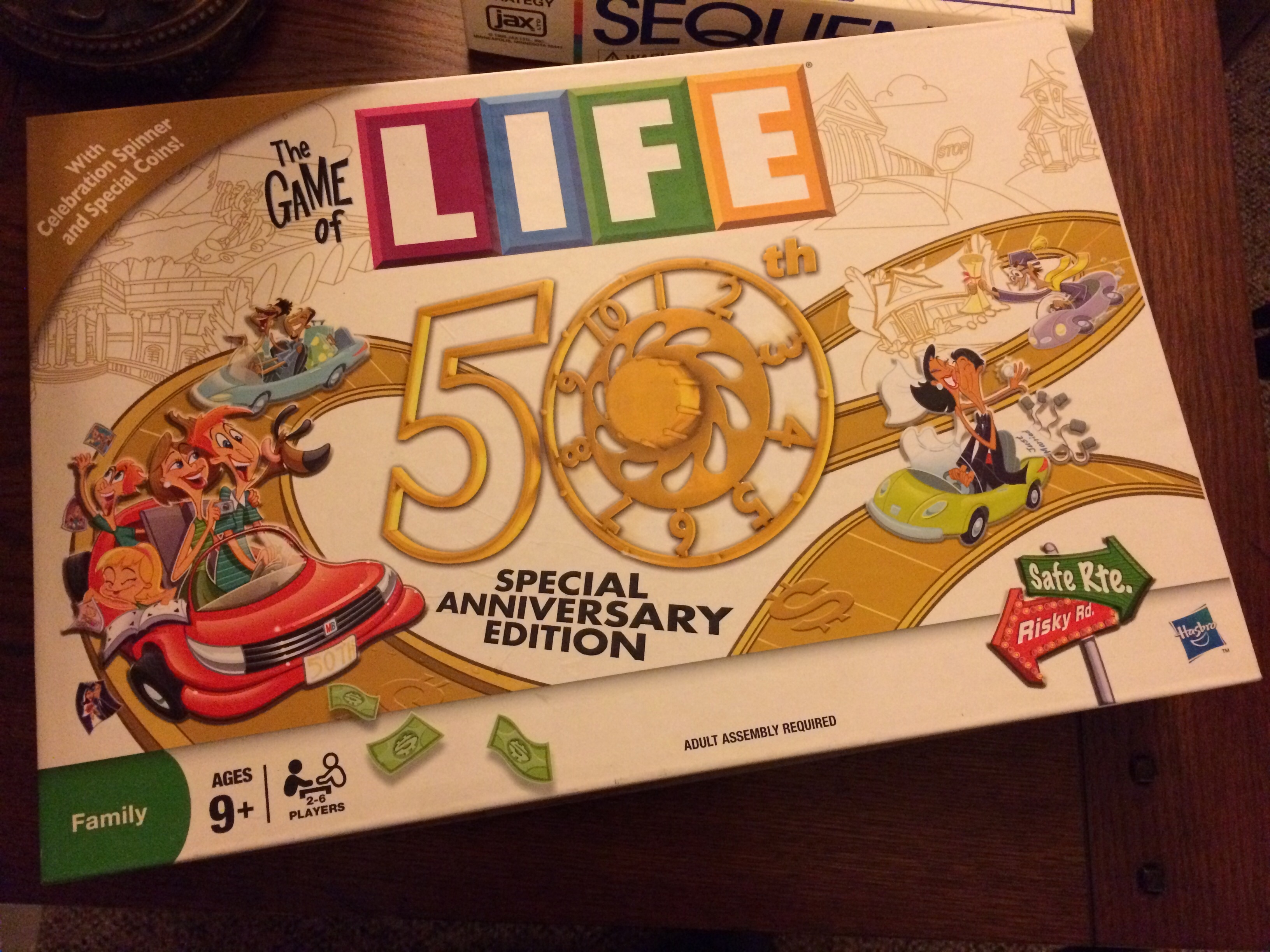

After a week of being sick followed by a three-day snow and ice storm, you can only watch so much Netflix and eat so many bowls of cereal and destroy so many tissues. So when the power goes out, you resort to all out ridiculousness and begin playing board games by candle light on a Friday night. We’re talking Sequence, Bananagrams, and good ole Life (the game, not the cereal as that had already been completely consumed earlier in the week).

We don’t consider ourselves “game” people. Music people, creative people, documentary people, active people–we’ll take any of those, but when someone excitedly invites us to game night, we often shrug our shoulders and wonder, “why us?” Don’t get offended, we’ll come to your game night, just don’t ever consider us regular attenders.

Anyway, the point is, we had maybe played Life once in our entire time of owning said board game, as evidenced by the lack of people pegs plucked from the plastic casing. I loved playing the game as a kid and dreaming what my life as an adult could be like. This particular version had a few new spaces and some modified rules, so I kept checking to read the rules to find out what different things meant. Half of the time spent was in set-up alone, so after the two of us played through rather quickly, we decided to play once more (and I might have needed a redemption round).

Here’s the thing, the game is rigged. You get so little control of what happens or doesn’t happen and very few choices throughout. Sometimes real life can feel like that I suppose, so for the sake of the game, I’ll let that slide (although I don’t think I’ll ever be a veterinarian turned entertainer turned hair stylist and later a Nobel Peace prize winner on accident).

My issue though was not that I lost (twice), but what determined the win. The whole game is just a big exchange of money. Maybe you pick up a few people pegs in your brightly colored car along the way, but each “life” event was represented in dollar signs. The best career to pick, the house to choose, the route you took–it was all solely motivated by ending up with the most pastel colored cash at the end.

Maybe you think I’m going too deep here, but indulge me for a minute–is that what life is? A long and winding path that declares winners and losers based on how much money you banked by the end? Are we so motivated and persuaded by the financial cost and benefit of things, that we give no other weight or meaning to what it is we are doing with our days?

I’m not so naive to think that money doesn’t matter. This last year was tough financially (to be all too honest) and obviously what we make does impact our every day life and has to be considered for our future. I’m not talking a pile of wealth to gloat about but more like, hey, we use money to pay the rent and put food on the table. So, yes, we need money, and it certainly comes in to play with many of our decisions since we don’t have the luxury of ignoring it.

But is it possible that society goes from basic necessities to a “success” measurement based merely on how high your money pile is? What about art? And creativity? Passion? People?

Is our impact and our worth instead better defined by the dollar amount we acquired at the end of the year?

I’m not opposed to getting or giving raises, far from it. Rent goes up every year, cost of living increases, needs change. Raises can show progress and reward work well done. Yes, let’s get raises. Also, it should be noted that passion projects have their own points of failure. Investing all of our time and energy in to something that has no return on our investment is, at times, maybe even negligent. Sure, you can have projects and pursuits that lead to little or no monetary gain, but there also has to be some balance and overall understanding of needs and responsibilities.

Okay, so we’ve established that I believe we should be paid and decently at that. But is there more? I think so. I don’t want the end to look like a pile of money, however big or small, declaring whether or not I won. I want it to look like a life that mattered, that I did something valuable with my time.

So, what value are we/you putting on money? Is it truly a living wage that allows you to live your life in a way that is also generous and creative? Or is it more so a measurement of your own personal value and a metric to constantly improve? Are those mutually exclusive?

The bottom line is perhaps, are we are asking the right questions, spending our money (and time and resources) the right way, and placing our value where it belongs?